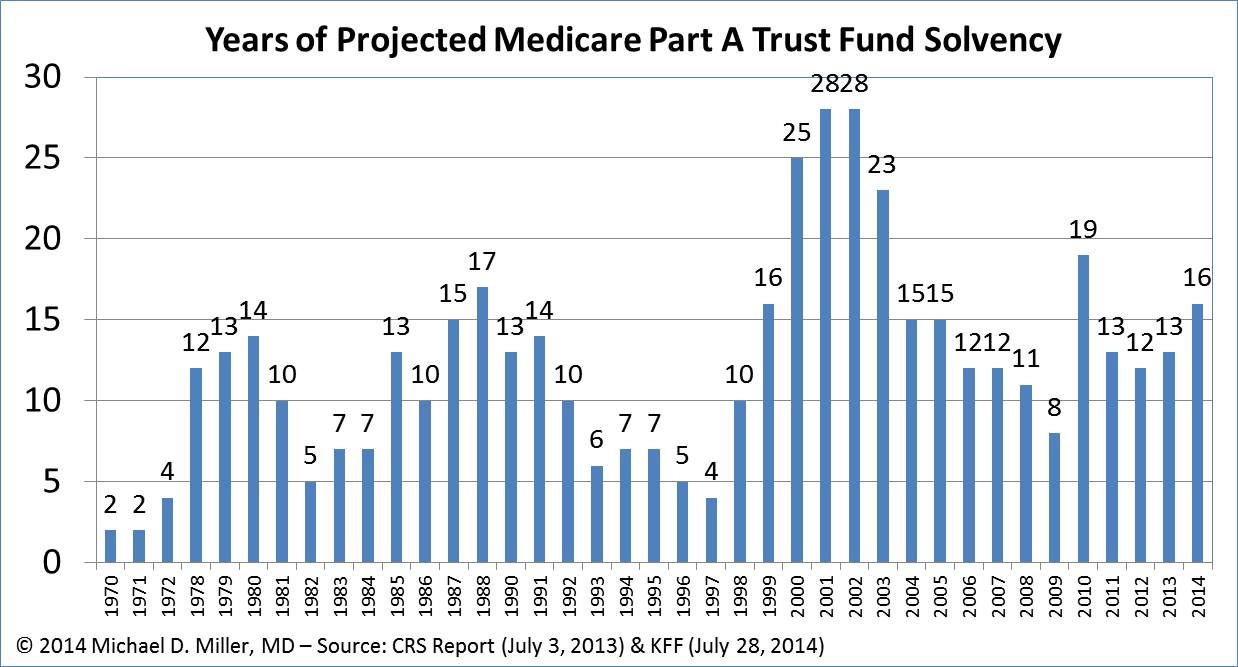

The 2014 Medicare Trustees’ Report was released yesterday. Amidst all the reporting was how the revised projections for the Medicare Trust Fund (for Part A) increased by 3 years from last year’s report. The Kaiser Family Foundation has a great summary of Medicare financing and projections for future spending, but below is another chart that shows the actual number of years of projected solvency for the Part A Trust Fund in the years since 1970 – in the years when the Trustees’ Report included such projections:

Two things to note about this chart: The dramatic leap up in 2010 mostly reflects a combination of the healthcare spending slowdown in the Great Recession and the legislative changes in the ACA that pared back Medicare payments. (Note – those payment reductions were included in Republican proposals for replacing/supplanting the ACA.)

Another interesting item in the Trustees’ Report that both Kaiser Family Foundation and Sarah Kliff have noted is an actual dollar decline in per Medicare beneficiary spending on hospital costs. This may be due to some combination of greater scrutiny for hospitalizations, greater efforts to avoid rehospitalizations, and medicines ability to treat more things as outpatients. However, it also might mean that Medicare enrollees are facing higher cost sharing if they are getting more treatments as outpatients, which are covered under Medicare Part B.

This all seems to confirm the old saying, “The more things change, the less they stay the same,” i.e., projections change as the underlying conditions don’t stay the same.

[…] ← Previous […]

I can see that the Medicare Trust Fund solvency projections are a way of indirectly seeing changes in the amount by which outlays are exceeding revenue. But isn’t the concept of the solvency of the trust fund a misnomer? Medicare at one point was taking in more than it paid out. Thus the books looked like there was a Medicare savings account that trustees could disburse funds from when benefits exceeded revenues, as is the case today.

But in the meantime the government as a whole was, except for a couple of years in the 1990s, borrowing to pay its debts. In deficit years, the amount of Treasury debt issued to the public was reduced by the amount of the FICA (Medicare and Social Security) surplus. (In surplus years the surplus was derived by subtracting all outlays including FICA outlays and from all revenue including FICA.) In other words, there is no segregated Medicare account that can pile up cash for the lean years even when the rest of the government is running a deficit.

One way of showing that there is no cash in the trust fund is to imagine that we do not raise the debt ceiling but instead put the government on a cash and carry basis, with separate categories for general expenditures, Social Security payments and Medicare benefits. If there were an actual Medicare trust fund in the way we think of private trust funds, Medicare payments would continue to be made out of a combination of current revenue and withdrawals from the trust fund. If there were no cash in the account then outlays would be limited to current revenues.

What do you think?